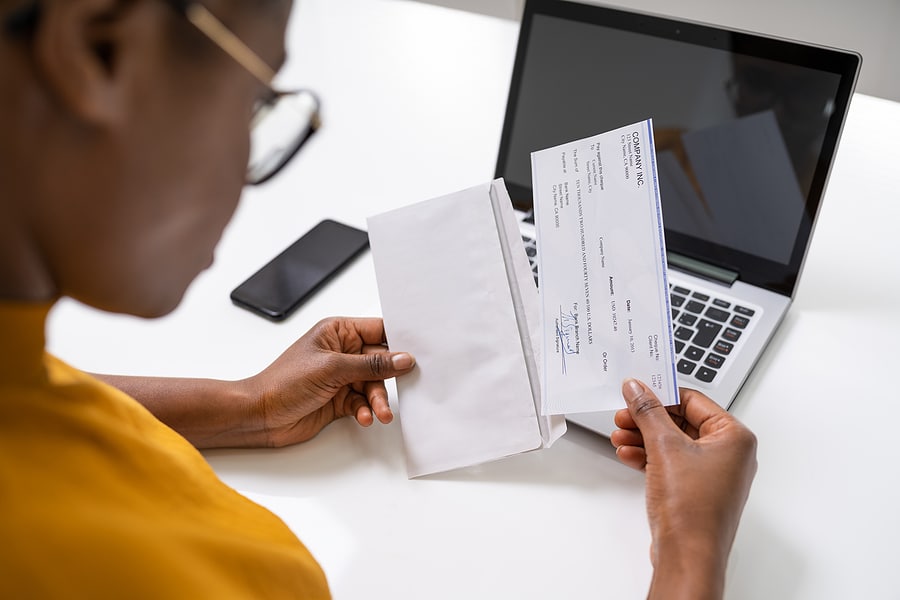

5 Benefits of Maintaining Accurate Payroll

Running a small business comes with a multitude of responsibilities, and one of the most crucial tasks is managing payroll. Accurate payroll isn’t just about getting your employees paid on time—it’s about ensuring compliance, maintaining trust, and making informed business decisions. Edgewater CPA Group manages the payroll for many small businesses; here are the top five reasons why accurate payroll is critical.