As a small business owner, managing payroll can be daunting. Not only do you have to ensure that your employees are paid accurately and on time, but you also need to navigate the complex world of payroll compliance. Failure to comply with payroll regulations can result in hefty fines that could jeopardize your business’s future. But fear not; this ultimate payroll compliance guide from Edgewater CPA Group provides you with the information you need to stay on top of your payroll obligations.

Understand Payroll Regulations

The first step in ensuring payroll compliance is understanding the regulations that govern it. Familiarize yourself with federal, state, and local laws governing minimum wage, overtime pay, tax withholding, and employee classification. Stay up to date with any changes in legislation that may impact your payroll processes. Doing so will help you understand how your payroll should work.

Implement Reliable Payroll Systems

Investing in reliable payroll software can streamline your payroll processes and help prevent costly mistakes. Look for software that automates calculations, generates reports, and provides reminders for important deadlines. If you don’t want to handle it, consider outsourcing your payroll to a reputable provider like Edgewater CPA Group.

Classify Employees Correctly

Properly classifying your employees as either exempt or non-exempt from overtime pay is crucial for compliance with the Fair Labor Standards Act (FLSA). Misclassifying employees can lead to legal trouble and financial penalties. Consult with an HR professional or employment lawyer if you are unsure about how to classify your employees.

Keep Accurate Records

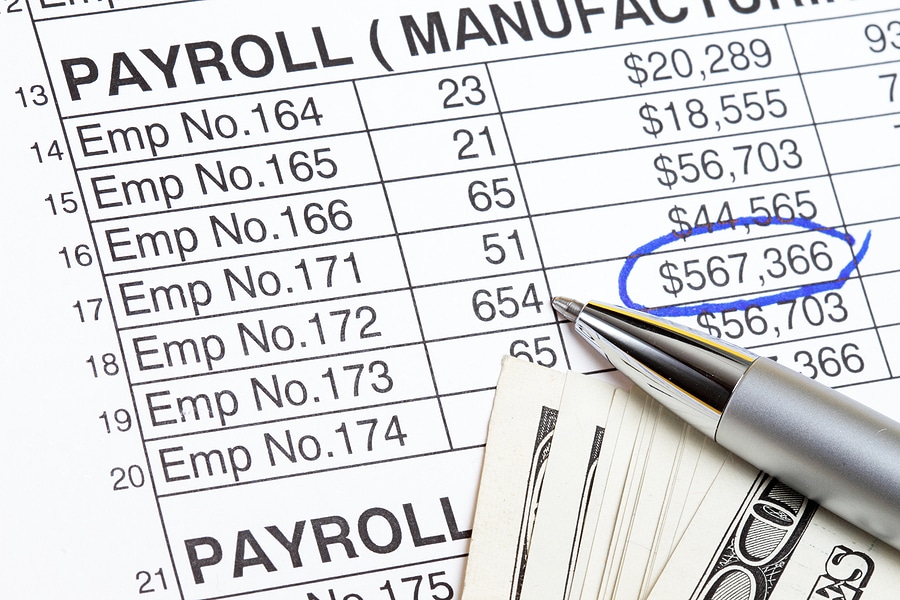

Maintaining accurate records of employee hours worked, wages paid, tax withholdings, and other payroll-related information is essential for compliance with federal and state regulations. Establish a record-keeping system that is organized, secure, and accessible in case of an audit by the IRS or Department of Labor.

Seek Professional Help

If navigating the world of payroll compliance feels overwhelming, don’t hesitate to seek help from professionals like those here at Edgewater CPA Group, who specialize in small business accounting services. We can provide guidance on tax obligations, assist with audits, and offer valuable insights into best practices for maintaining compliant payroll processes.

Stay Compliant with Your Payroll

Staying compliant with payroll regulations is crucial for the success and longevity of your small business. Remember that compliance is not just about avoiding penalties—it’s about creating a fair and transparent work environment for your employees while protecting your business from legal risks. If you’re ready to outsource this task for your business in Carmel, IN, call Edgewater CPA Group. We’ll not only run your payroll, but we’ll also do your bookkeeping and tax prep. Schedule your consultation today at (317) 386-7021.